OCBC Bank proudly announces the launch of the enhanced Mobile App. This upgrade features new interface and functions that bring you an enhanced Mobile Banking experience.

* Optimized Services *

- In-app keyboard

More services:

- Customer Suitability Assessment

- Remote Account Opening

- Biometric Logon

- All-in-one Investment Account Opening

- “My Portfolio”: Lists all account balances and provides transaction history enquiry function

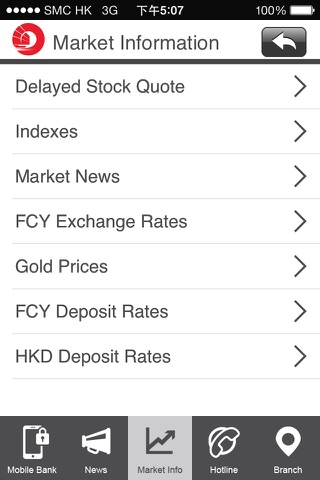

- Securities: Buy/Sell order, order status enquiry, cancel order, stock balance, real time stock quote, and market information enquiry

- eIPO and Financing

- Account Services: Transfer & Pay, account balance enquiry, remittance enquiry

- Faster Payment System (FPS) - Small-value Transfer: Instant cross bank transfer

- Faster Payment System (FPS) - Account Binding: Set your OCBC Bank account as FPS default account

- Foreign Currencies & Gold: Currencies exchange, gold trading, pre-set buy/sell order

- Buy / sell / switching of unit trust and Risk Profiling Questionnaire

- eBanking Registration Service

- eStatement Service

- Remittance Service

- Latest product info and promotion offer

- Instant foreign currency exchange rates, gold price, and deposit interest rate enquiries

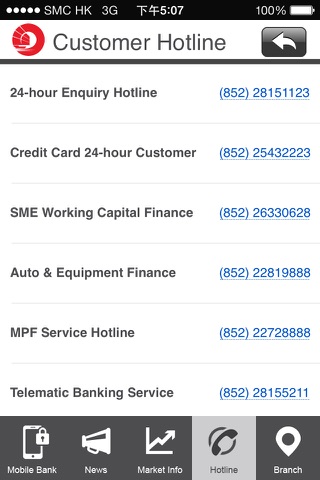

- Branch & ATM locator

- Transfer & Pay service

- Wealth Management Connect (WMC) e-Banking PIN activation

- Reset User ID and/or PIN Service

- ATM Card Activation

- Push Notification

- Dormant Account Activation

- Discontinue Paper Statement & Advice

- A brand new prelogin page design to enhanced Mobile Banking experience

- New features of Curreny-linked Deposit

- Enhanced “Card Services” function

- Enhanced "All-in-one Investment Account Opening" function

The above products and services are subject to the relevant terms and conditions. For details, please visit any of our branches.